Engineering, Procurement and Construction (EPC)

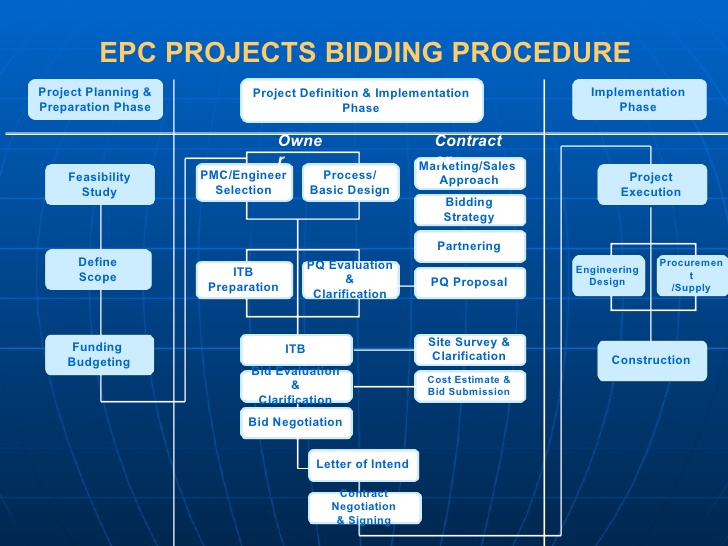

EPC includes engineering, procurement, and construction. Companies that deliver EPC Projects are commonly referred to as EPC Contractors. In an EPC contract, the EPC contractor agrees to deliver a fully commissioned plant to the owner for a fixed fee. The engineering and construction contractor will carry out the detailed engineering design of the project, procure all the necessary equipment and materials, and then construct to deliver a functioning facility or asset to their clients.The plant owner must have a clear idea as to the scope of the project. Any changes later are likely to be costly. Clients must then choose a reputable and experienced EPC contractor and get the design of the plant and associated machines inspected by in-house experts or external consultants before proceeding.

How can we help to you?

We can help to find the best EPC contractor to the client and negotiate with the contractor to execute and deliver the project within an agreed time and budget. Also to the important projects, we will assign a project management team to overlook the EPC contractor and as specialist to help and bring on board project management team consultants and will feedback the clients about the schedule of projects in accordance with the contract periodically.

Initial Public Offering (IPO)

An initial public offering (IPO) is the first time that the stock of a private company is offered to the public. IPOs are often issued by smaller, younger companies seeking capital to expand, but they can also be done by large privately owned companies looking to become publicly traded. In an IPO, the issuer obtains the assistance of an underwriting firm, which helps determine what type of security to issue, the best offering price, the amount of shares to be issued and the time to bring it to market.

How can we help you?

Getting a piece of a hot IPO is very difficult, if not impossible. You may know the process of underwriting or not and as one of the most professional consulting platform, we understand the process and whom should be get involved in order to make IPO successfully. It is a big step for any company but ambitious and you will have a dramatic transformation. You need know how to pick up a right investment bank, the amount of money company will raise and the type of securities to be issued and all the details in the underwriting agreement. If you know nothing about it, it’s very difficult to learn from zero and you definitely need hire someone like us to negotiate everything for you on behave of your own interest. It is very important and not also save money and time, but essential and wise choice to work with experts and step into the equity market.