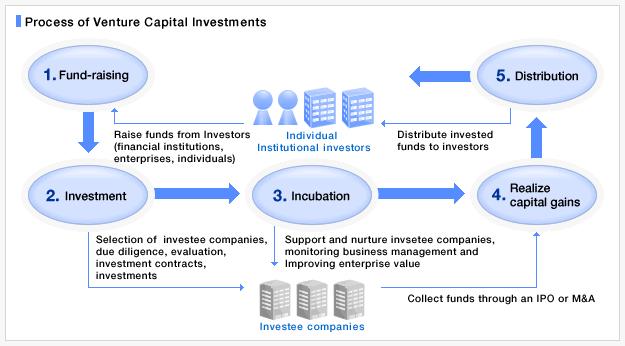

Venture Capital

Venture capital is financing that investors provide to startup companies and small businesses that are believed to have long-term growth potential. For startups without access to capital markets, venture capital is an essential source of money. Risk is typically high for investors, but the downside for the startup is that these venture capitalists usually get a word in company decisions.

How can we help you?

If you are optimistic risk-takers and considering to cultivate young entrepreneurs, to make your investment more meaningful and profound, this is the right place you are now. We can find international venture capital firms that allow the investors across multiple stages to reshape the markets and even change the world like famous Facebook, Uber etc., along with the big trend of one belt one road, you may become the next successful investors for the next social trend or future icon of entrepreneurs.

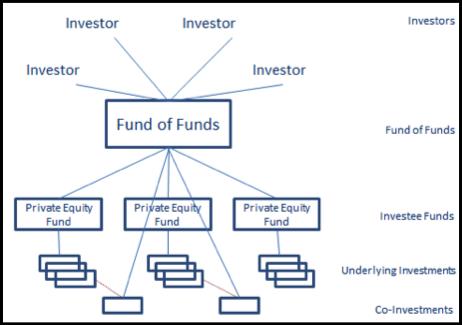

Fund of Funds

A fund of funds (FOF) - also referred to as a multi-manager investment - is an investment strategy in which a fund invests in other types of funds. This strategy invests in a portfolio that contains different underlying assets instead of investing directly in bonds, stocks and other types of securities. Investing in a FOF gives the investor professional financial management services. This experience allows the investor to test investing in professionally managed funds before they take on the challenge of going for individual fund investing. Most FOFs require a formal due-diligence procedure for their fund managers. Applying managers' backgrounds are checked, which ensures the portfolio handler's background and credentials in the securities industry.

How can we help you?

If you have relatively smaller investable assets, limited ability to diversify within the fund arena, or who are not that experienced with this asset class. We highly recommend to contact us with FOF model as it serves normally for the government industry funds plus private equity, and has long term stable return in the OBOR projects, suitable for the individual investors who search for 5-7 years’ international project investment with government.